Finance

Mother Finance Co., Ltd. (Registration No. 2263/2014-2015) is incorporated in the Republic of the Union of Myanmar and licensed as a non-bank financial institution (NBFI/FC(R)-11/08/2016). We provide consumer loans through our digital lending mobile application that automates underwriting process in real time using thousands of alternative data signals. Anyone with a smart phone in Myanmar can apply for an unsecured loan and receive a quick credit decision, regardless of their financial history. We offer fast, easy and customized loans to borrowers and help them access to finance, build digital credit histories, or financial identities, over time. Within 6 months of operations, we have acquired around 12,000 registered users and processed about 2,000 loans.

|

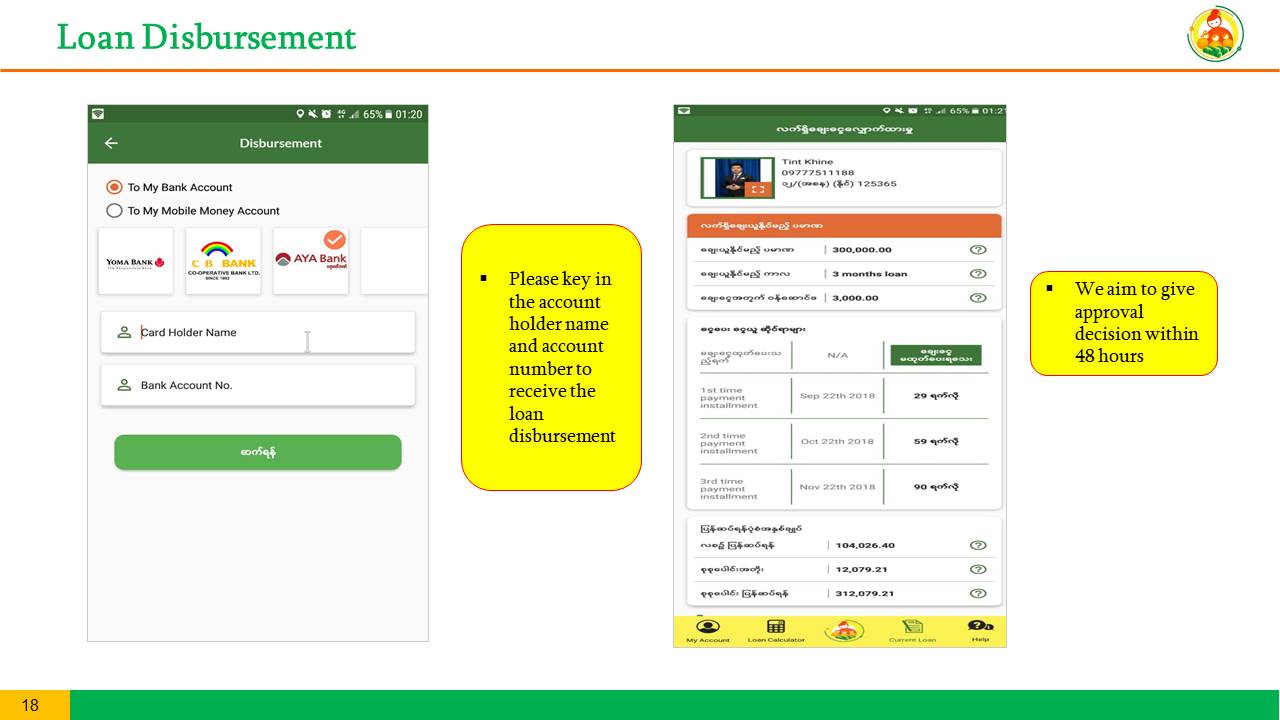

Quick Target to provide our customers approval for credit within 48 hours. |

|---|---|

|

Easy No paperwork or collateral required. Apply for a personal loan 24/7 anytime, anywhere using Mother Finance App. |

|

Transparent No hidden fees or charges. Get lower interest, and higher loan amount with every successful repayment. |

|

Secure We use industry standard security measures. We never release user data to third parties. |

Our Services

Mother Finance is another company being recently set up that will provide the following financial services:

-

Soliciting and raising long term deposits / investments from foreign and local investors.

-

Receiving loans from foreign and local banks and financial institutions.

-

Lending with or without collateral

-

Sme loans

-

Development loans

-

Equipment financing

-

Hire / Purchase

-

Security agency/ Collateral agency

-

Other financial services

Mission & Vision

To transform the financial sector in Myanmar to make credit more affordable and investing more rewarding. Mother Finance's technology platform enables it to deliver innovative solutions to borrowers and investors in the long term.

How It Works

Your Personal Loan, Tailored for You.

Emergency cash needs? Paying for a large expense like a computer, home renovation or a special occasion? We have you covered.

Help Center (Questions? We have answers.)

Q How does my money arrive?

A Your funds are deposited directly to your personal bank account.

Q What can I use my loan for?

A Your Loan can be used for emergency medical expenses, purchasing goods, repayment of high cost debt, home improvement, and more.

Q Can I pay off my loan early?

A Absolutely, You can pay off your loan early, with no pre-payment penalties.

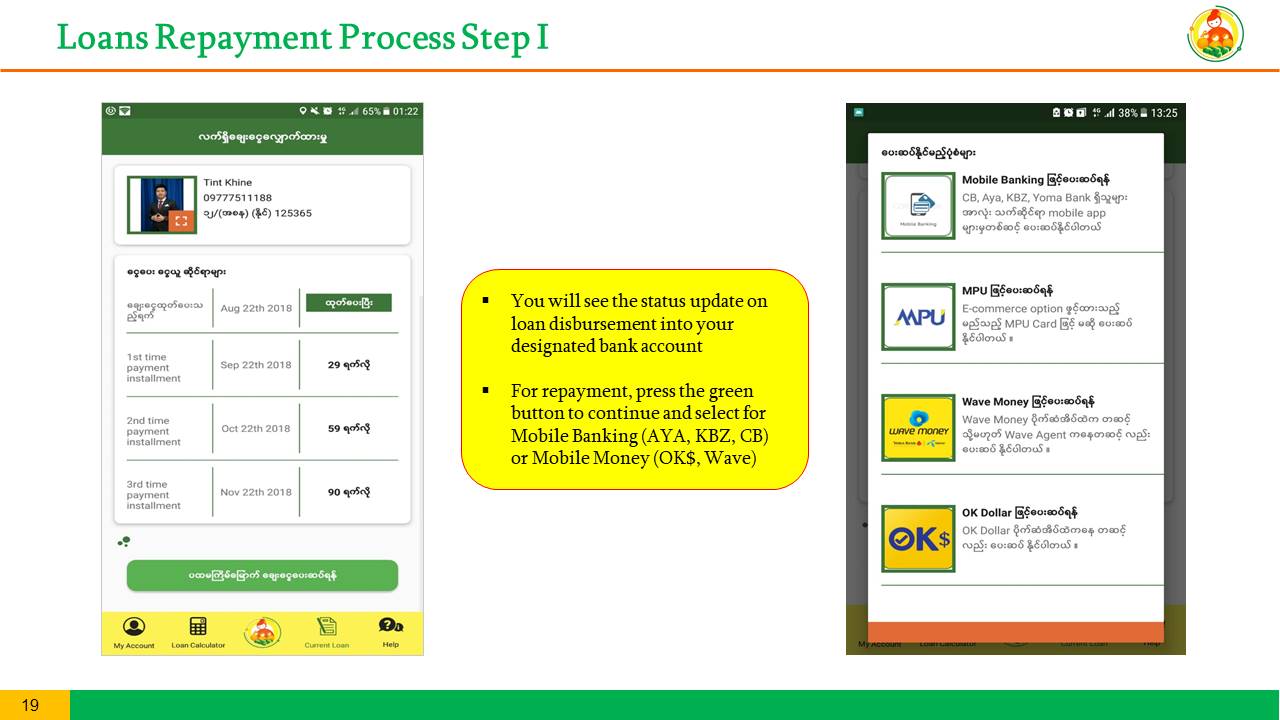

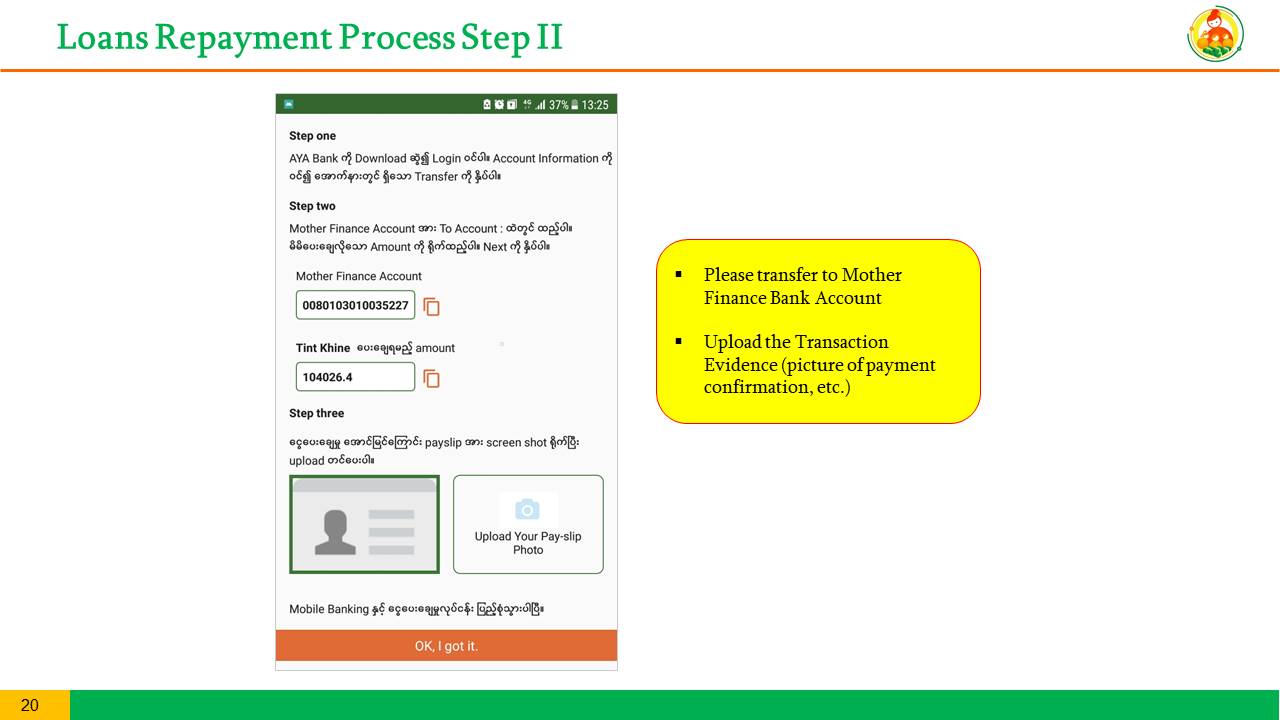

Q How can I make repayment?

A As long as you have a Myanmar Payment Union Card (MPU) card, you can repay us through our Mobile App with a secured token. You can also make monthly repayments online via mobile or internet banking, Wave Money or OK Dollar applications.

Q How quickly can I apply for a loan?

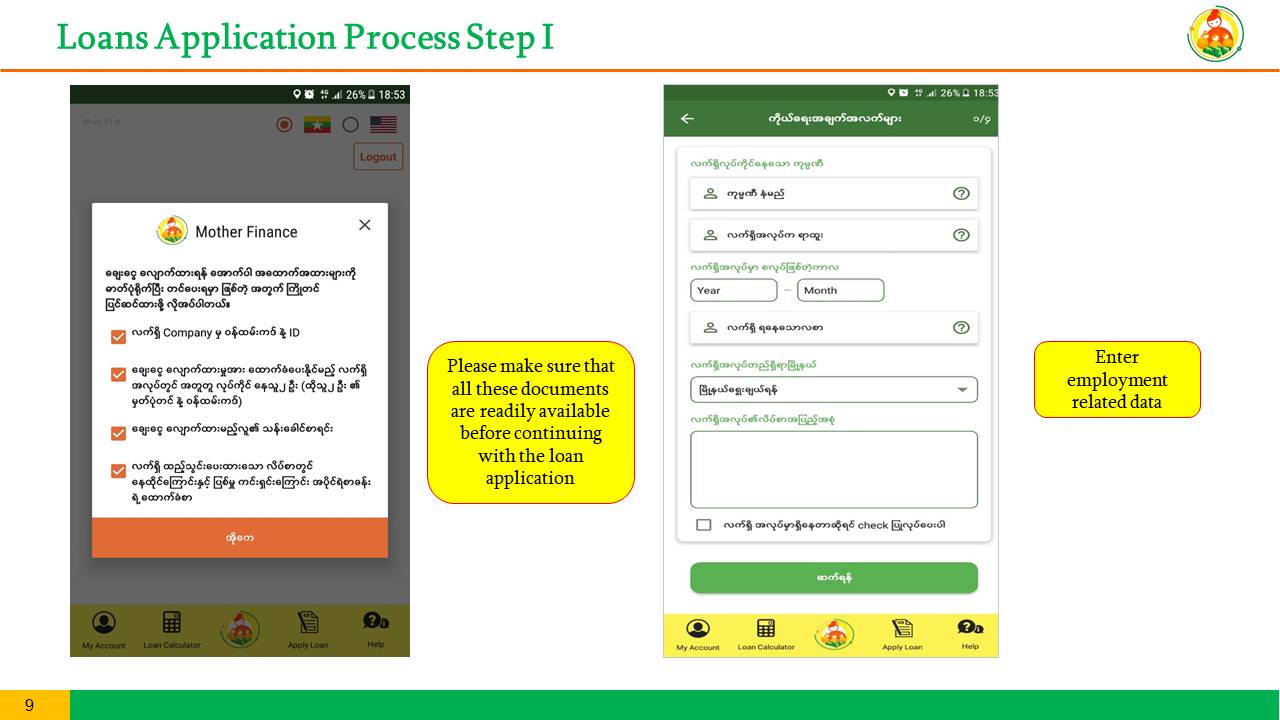

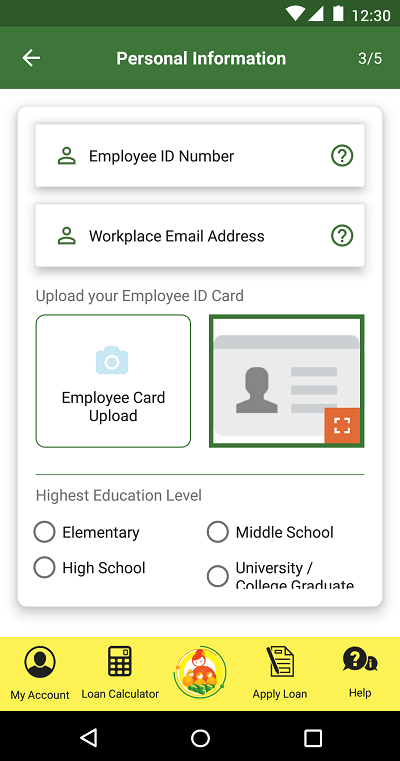

A Loan application will be accessed on our Mobile App and it should take less than 15 minutes to fill out, provided all the documents requested are ready.

Q When will get I get the money?

A Borrowers should receive the funds within 1-3 days of accepting their loan offer.

Q How long will it take to get loan approval?

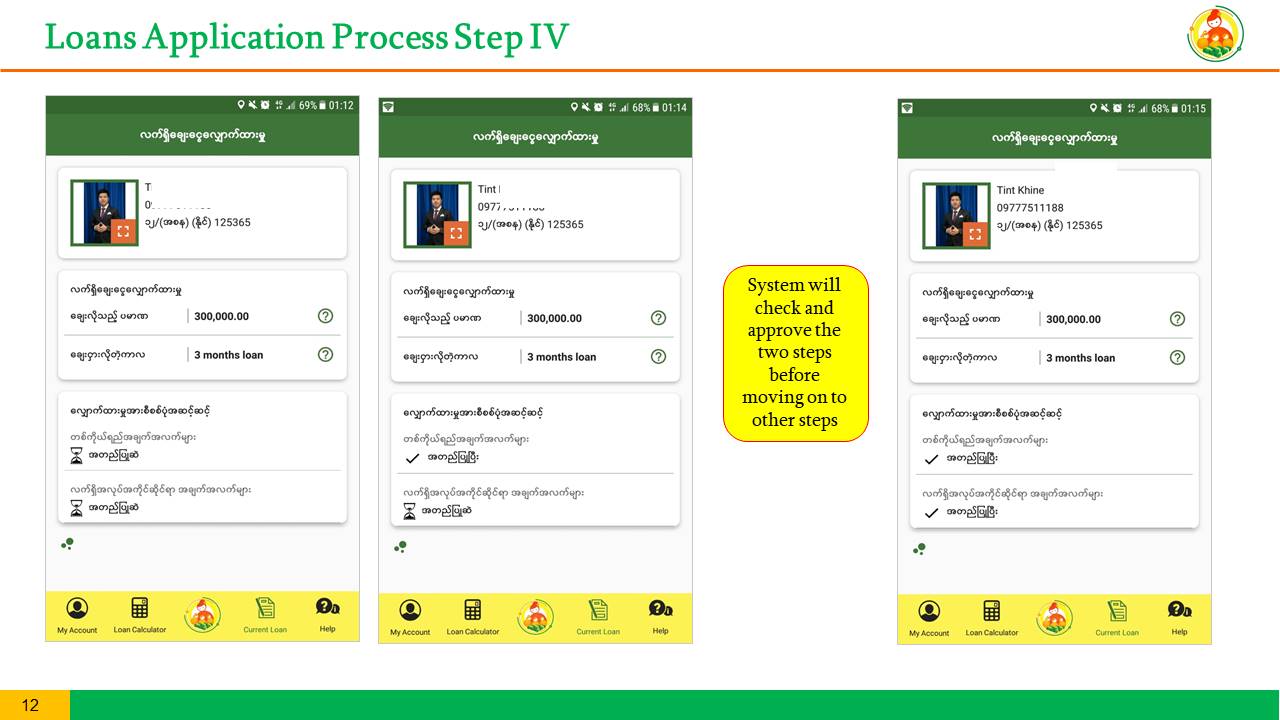

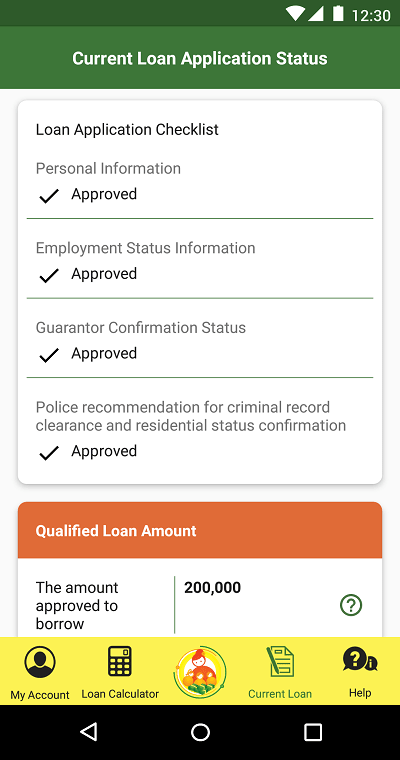

A On average, borrowers will know the loan approval decision within 48 hours after submitting all the documents requested.

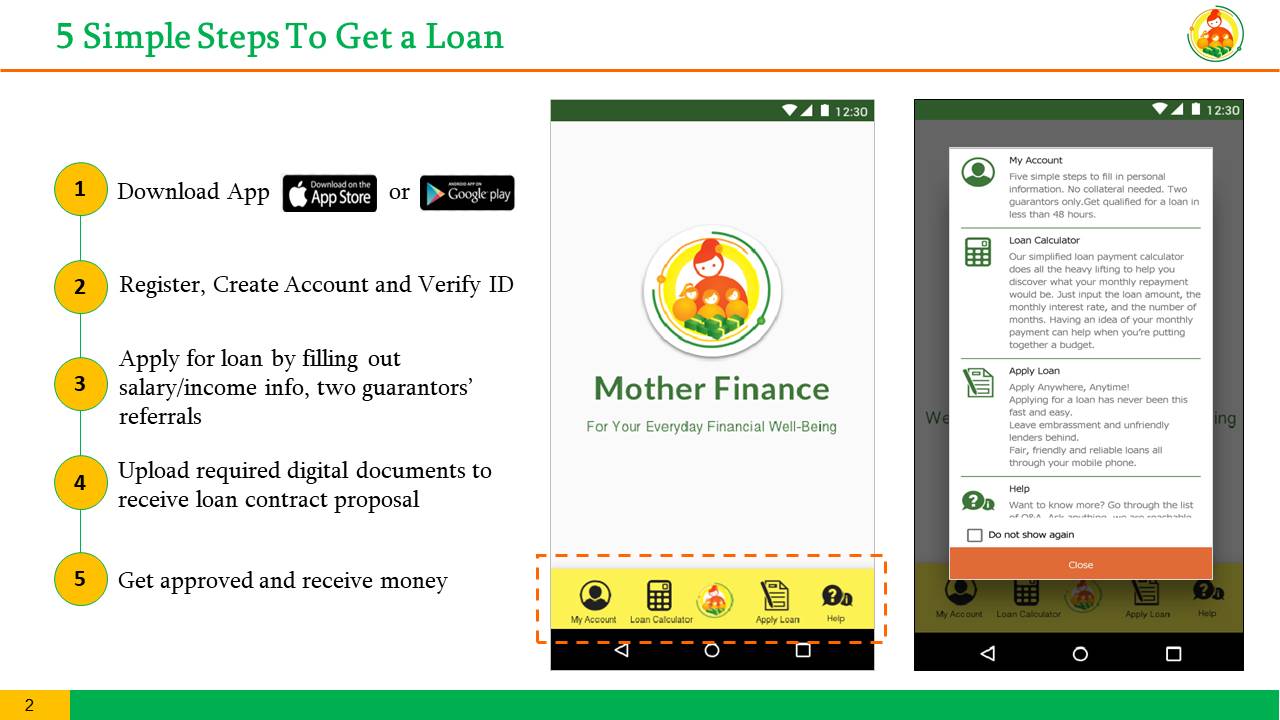

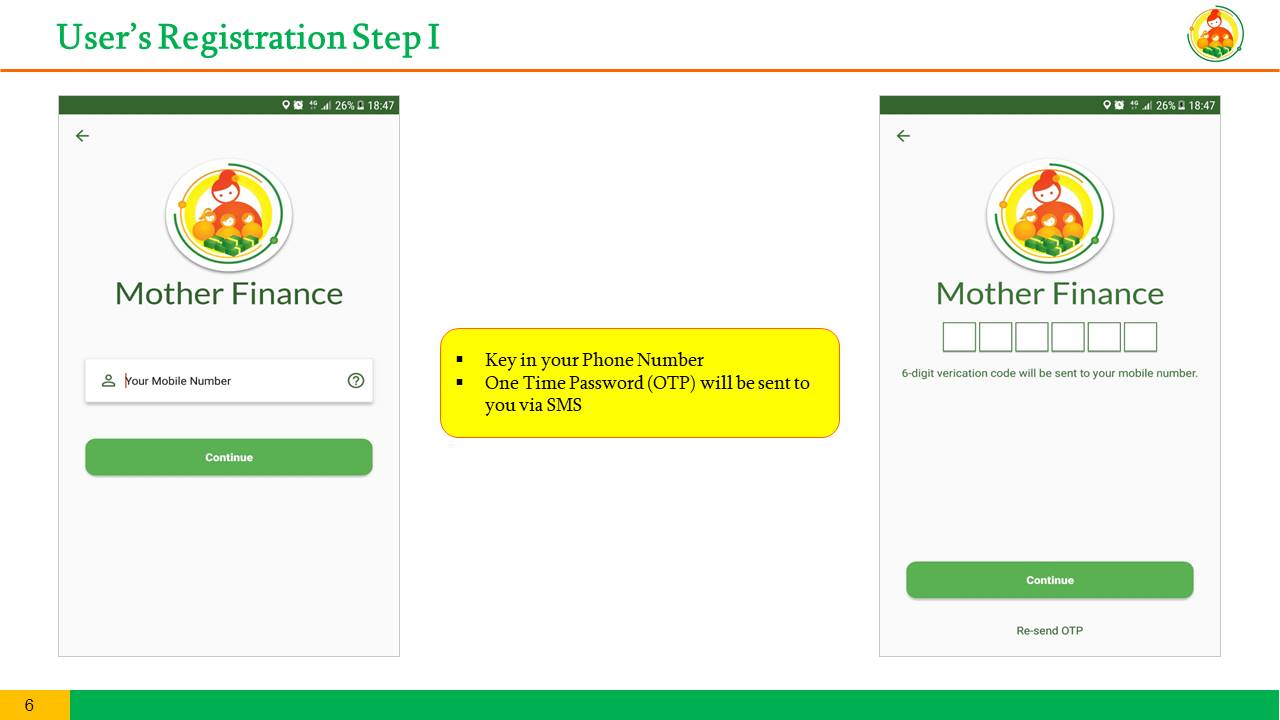

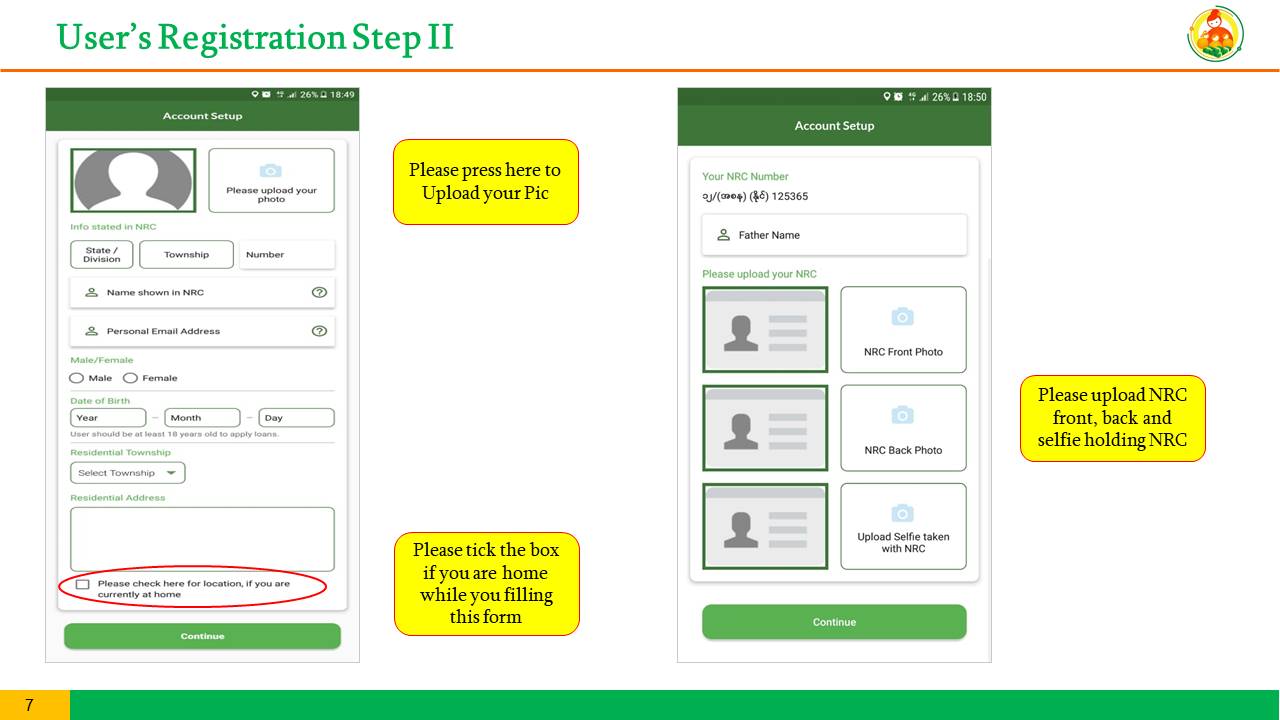

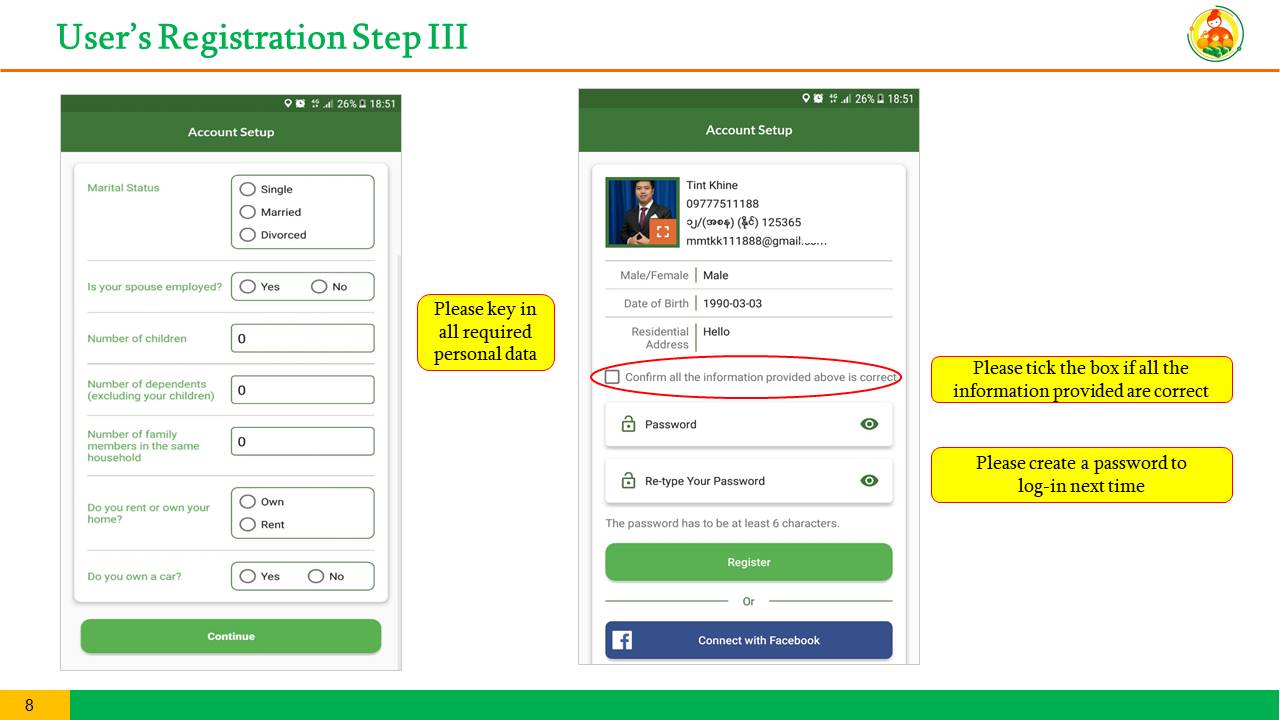

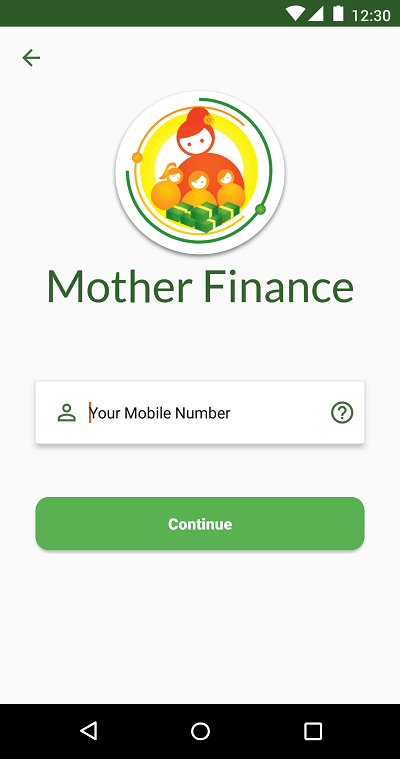

Get Started With User Guide

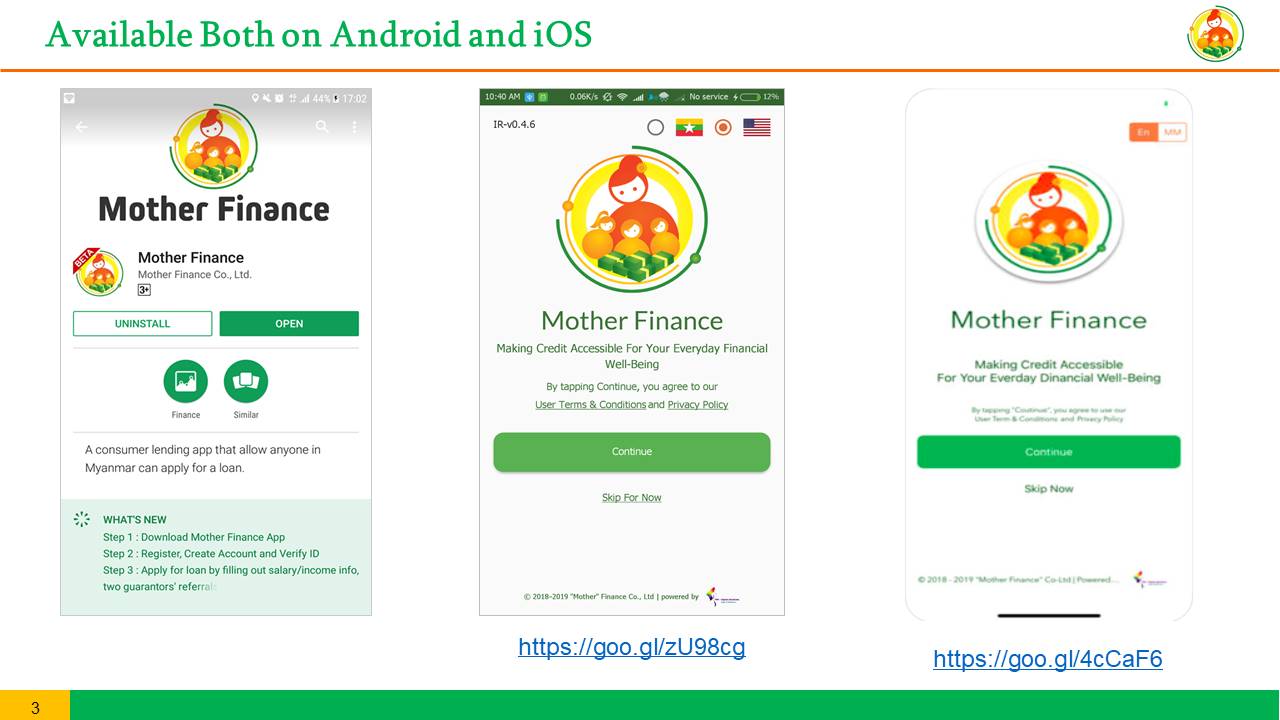

Download Mother Finance App

Register, Create Account and Verify ID

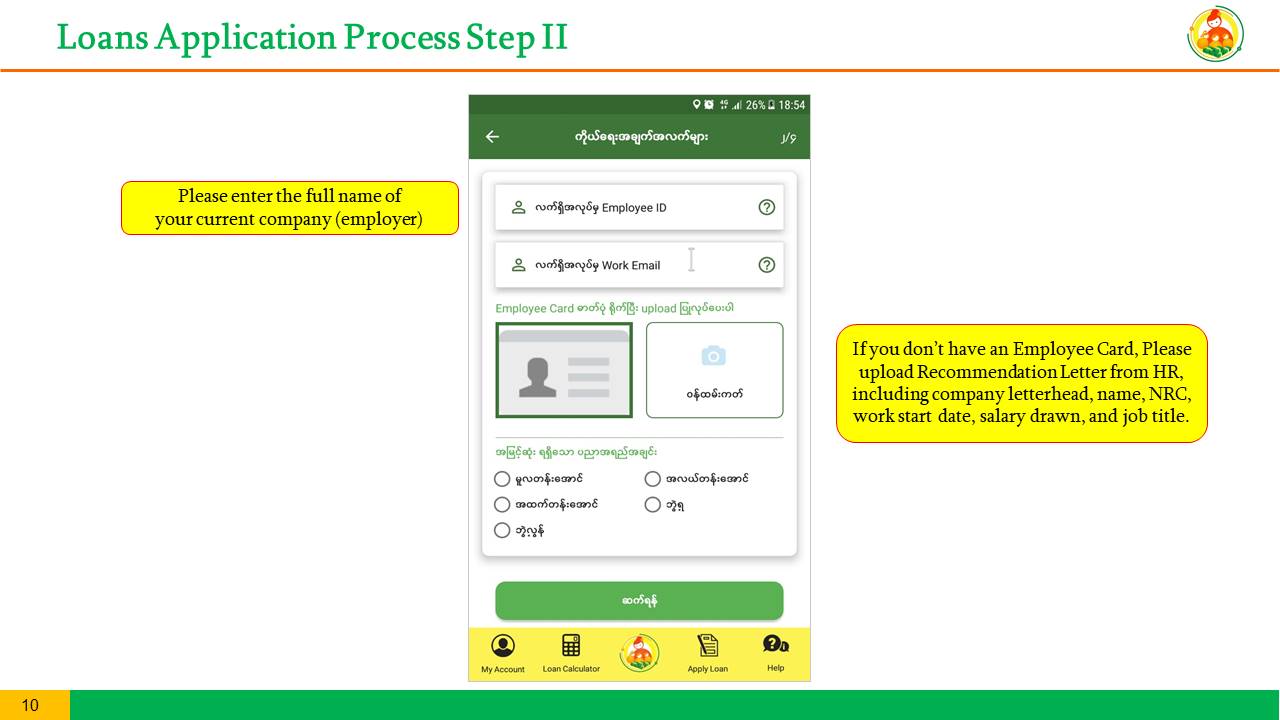

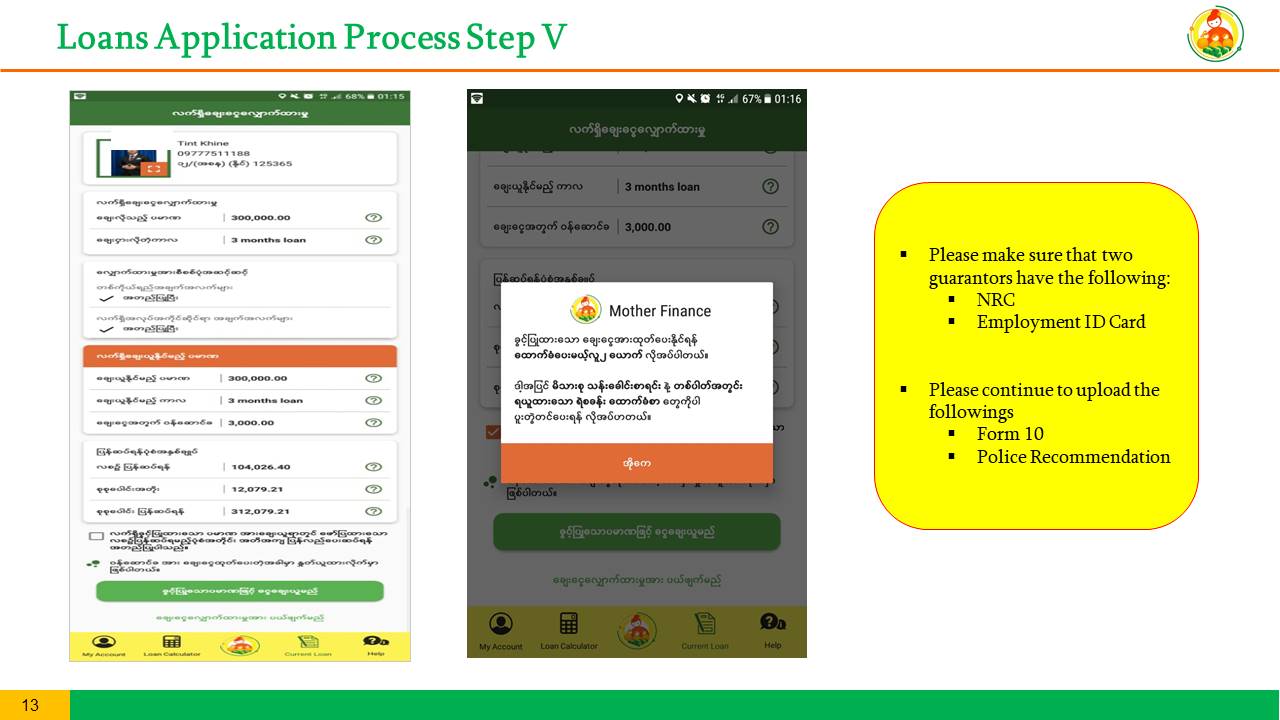

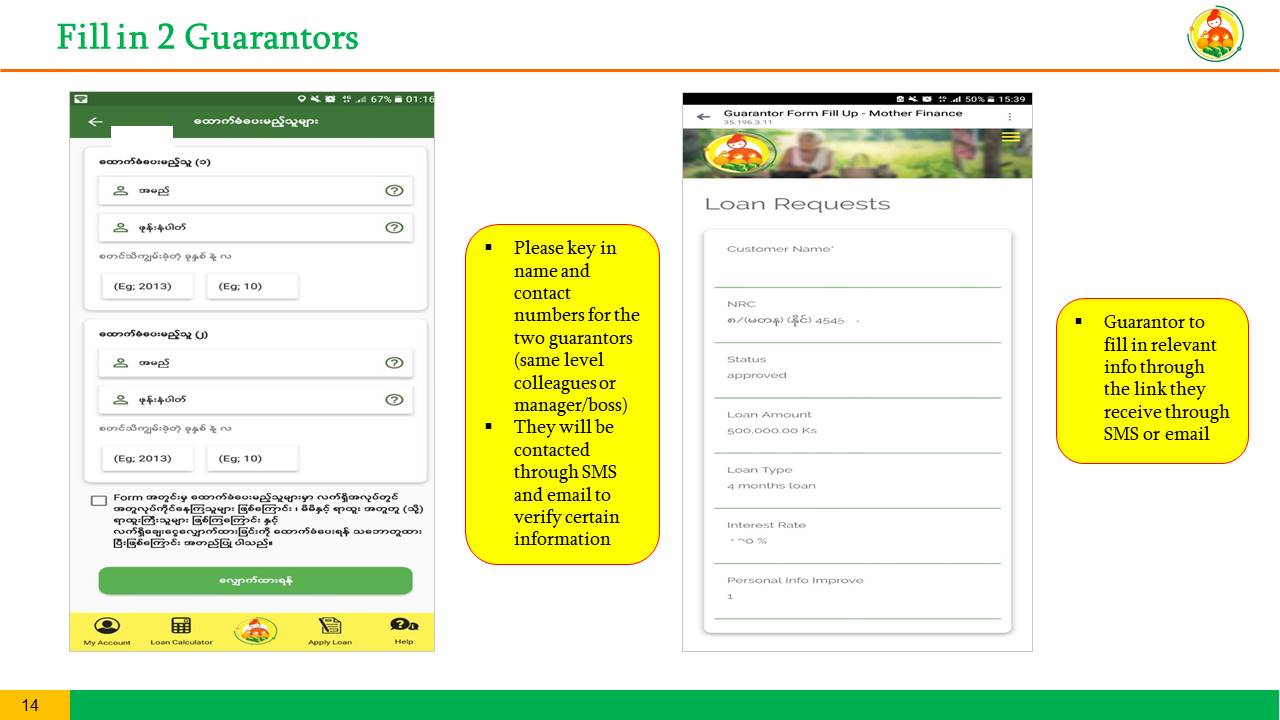

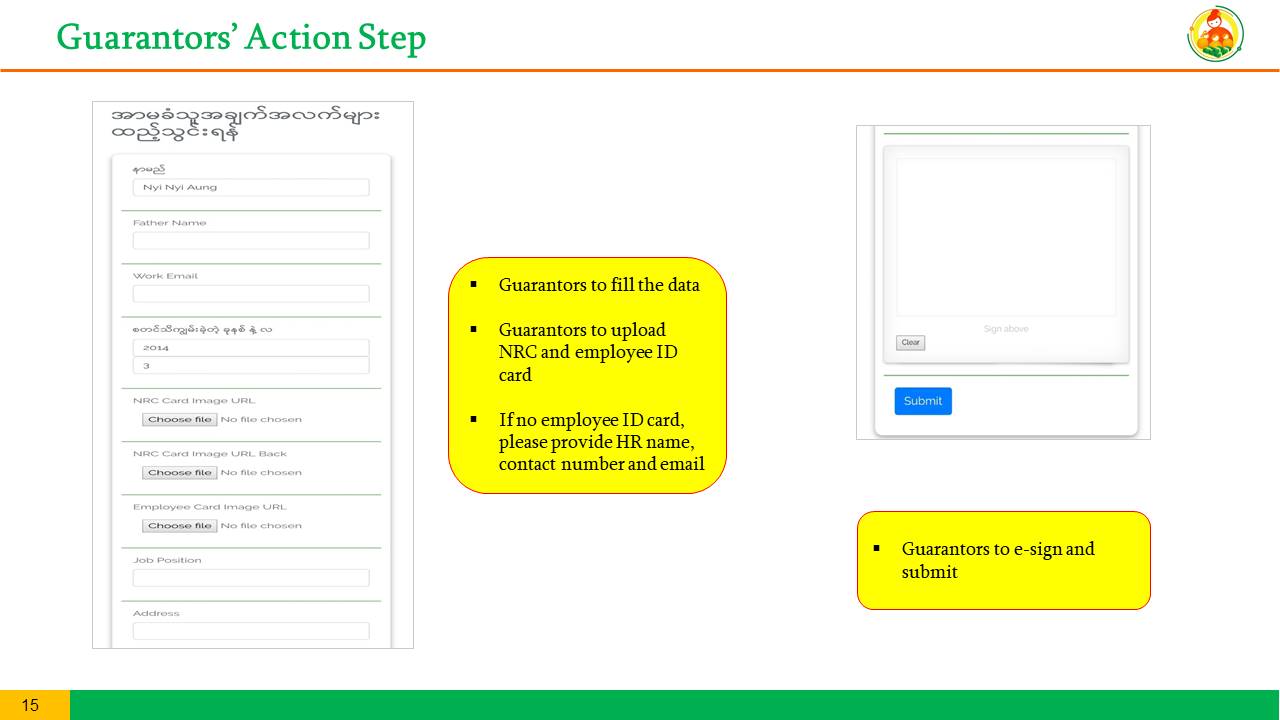

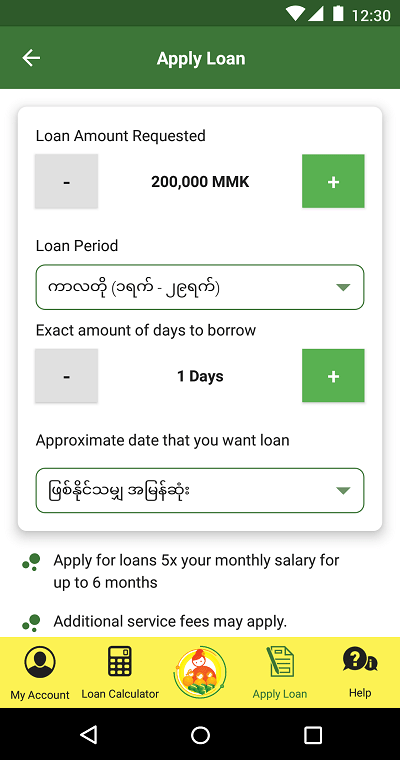

Apply for loan by filling out salary/income info, two guarantors' referrals

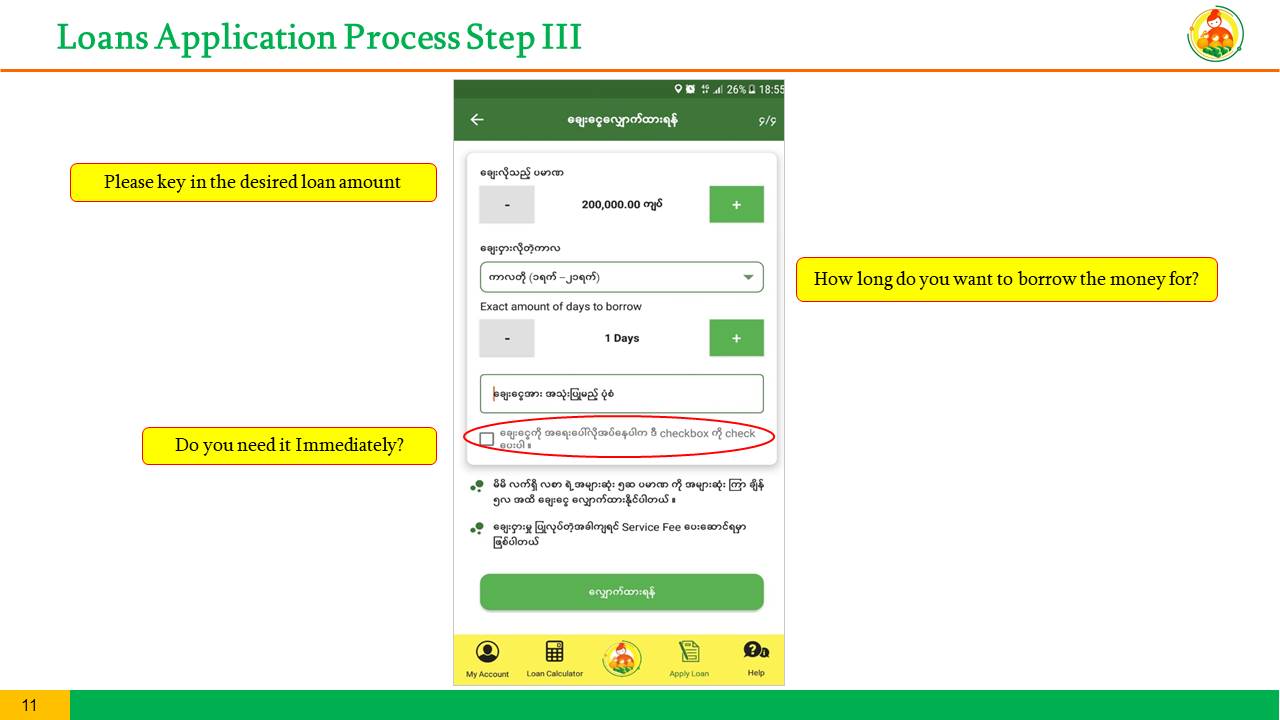

Choose Loan – amount, and term that works best for you

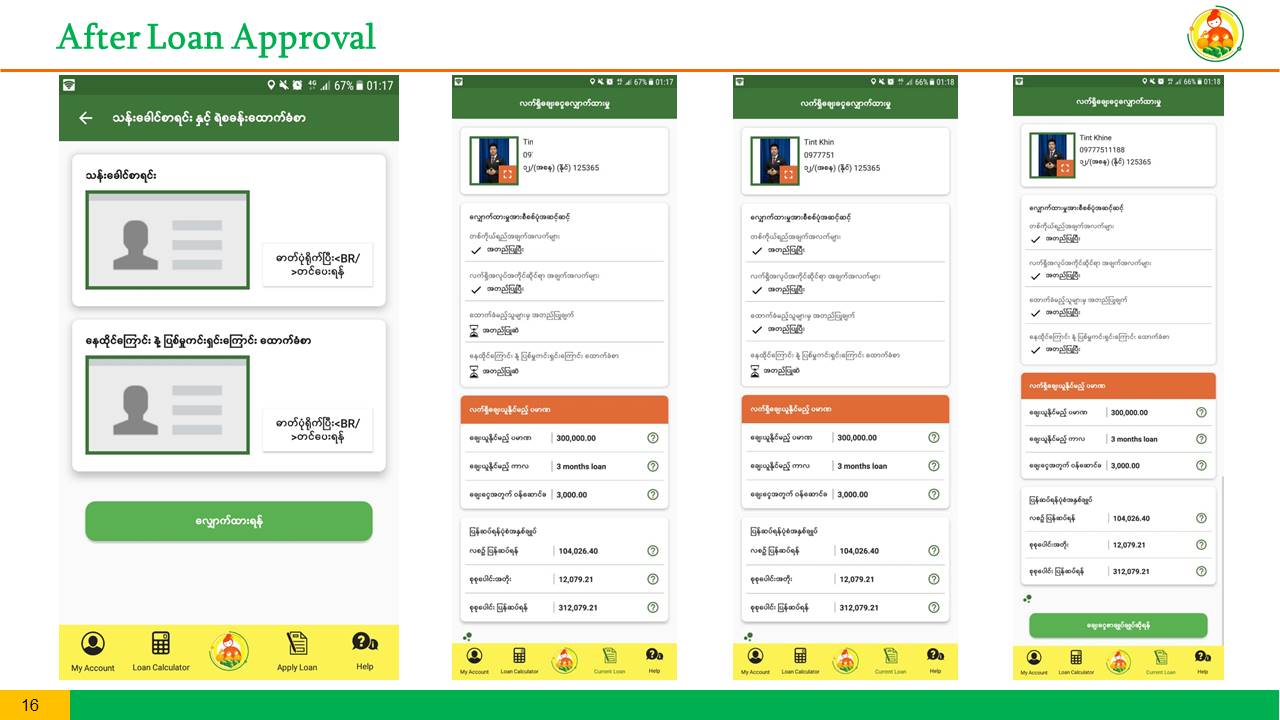

Get approved and receive money

Free Download Application.